With respect to the implementation of the EU Sustainable Finance Disclosure Regulation 2019/2088 (hereinafter ‘SFDR’), the integration of sustainability risks into the investment policy, ecological and/or social aspects of DD Equity Fund, and adverse effects of the investments on sustainability factors are discussed below.

Summary

This financial product promotes both ecological and social characteristics, but does not have a sustainable investment objective.

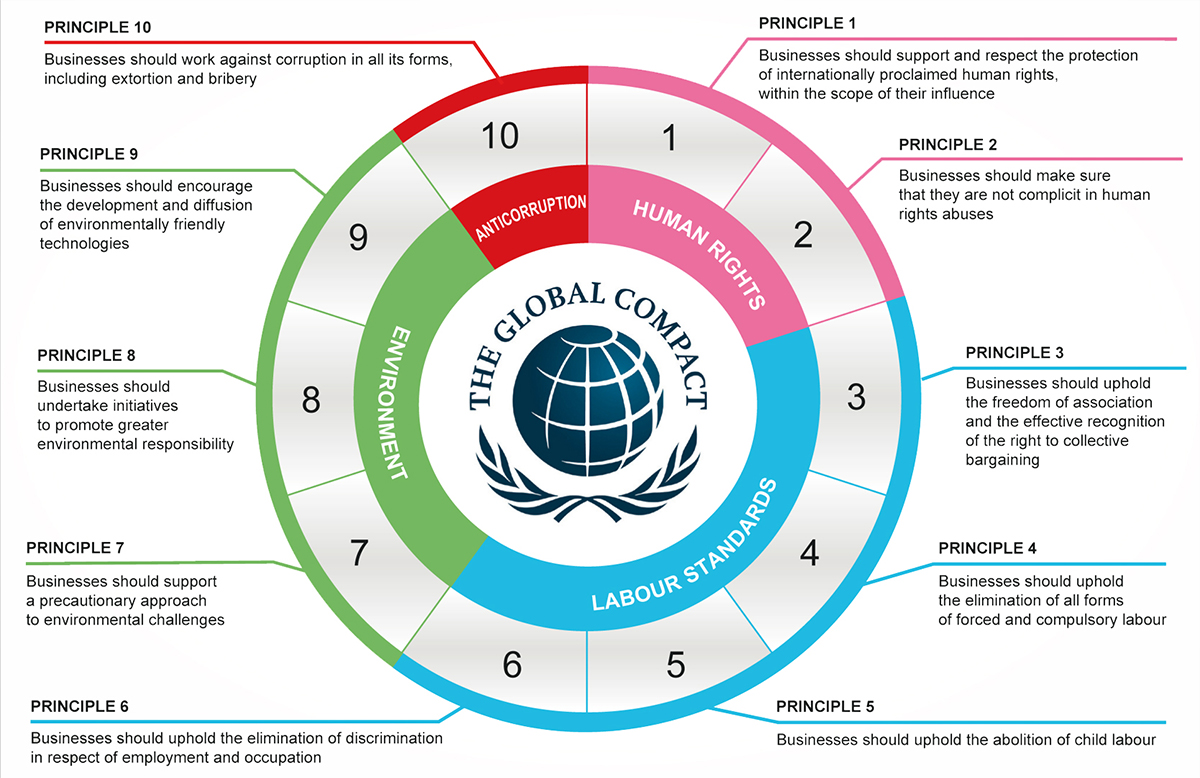

Ecological and social characteristics are promoted by only investing in companies that do not grossly violate the UN Global Compact Principles and certain exclusions. In addition, it is examined whether the selected companies make a substantial effort in the climate and ecosystem challenge. More specifically, this involves promoting climate mitigation, pollution prevention and control, and the protection and restoration of biodiversity and ecosystems. For social characteristics, it more specifically promotes human rights, labour rights, good health and good financial health.

DD Equity Fund is a global equity fund that invests in a diversified portfolio of high-quality companies that operate at the forefront in terms of sustainability. To ensure that investments are only made in such companies, an ESG analysis is carried out. ESG stands for Environmental, Social and Governance. The ESG analysis includes a large number of indicators that map a company’s environmental and social characteristics. These include information on CO2 emissions, biodiversity, water use and recycling, waste streams, board diversity, remuneration policy and shareholder rights.

As a result of the ESG analysis, DD Equity Fund invests in companies that play into opportunities, offer solutions and have a positive impact with their production process, products and/or services on one of the challenges identified by DoubleDividend Management B.V. (the Administrator): climate, ecosystems and welfare.

The ESG analysis is updated every year for each company with the latest data and other details. This monitors whether the respective company in the investment portfolio meets the environmental and social characteristics. The company is continuously monitored for news reports. In case of a gross violation of, for example, the UN Global Compact Principles, a decision can be made to sell the position.

The exclusions list is updated at least quarterly, or if necessary e.g. due to implemented sanctions or a gross violation of the UN Global Compact Principles.

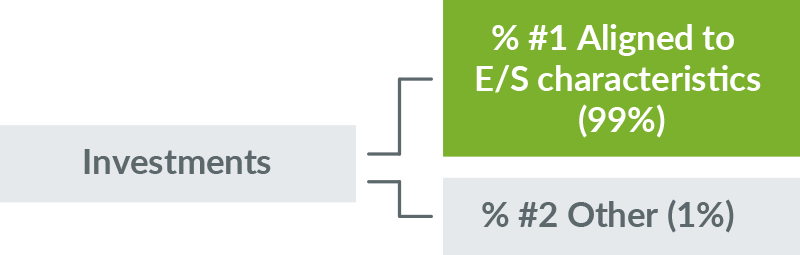

The proportion of investments aligned with environmental and social characteristics is 99%. Other investments consists of the average liquidity position in DD Equity Fund.

The ESG analysis uses the same definitions as applicable laws and regulations. This allows DD Equity Fund to measure whether the promoted ecological and social characteristics are achieved.

Bloomberg and companies’ annual and sustainability reports and websites are used as data sources for the ESG analysis. The data from Bloomberg is automatically loaded into the ESG analysis of the respective company. This data is verified with public sources from the company. The data is then analysed and an impact analysis is done. No proprietary estimates are used, external data providers such as Bloomberg may use estimates.

The main limitation of the data sources used is that certain data is not (yet) given by companies. However, important data such as CO2 emissions, biodiversity, water use and reuse, waste streams, board diversity, remuneration policy and shareholder rights are reported by an increasing proportion of companies. This allows DD Equity Fund to determine whether the promoted environmental and social characteristics are being achieved.

The *Asset Manager has a Stewardship Policy (Policy on Engaged Shareholding).

For DD Equity Fund, engaged share ownership (engagement) is an important part of the investment process. For DD Equity Fund, engaged share ownership means:

1) knowing what you are investing in

2) investing with conviction

3) feeling responsible for investments and

4) being accountable.

After investing, DD Equity Fund acts as an engaged shareholder. DD Equity Fund makes use of its shareholder rights and if necessary the board of a company is challenged to apply and improve their environmental, social or corporate governance policies.

No sustainable investment objective

This financial product promotes environmental or social features, but does not have a sustainable investment objective.

Ecological or social characteristics of the financial product

DD Equity Fund promotes both ecological and social characteristics.

Ecological attributes are promoted by only investing in companies that do not grossly violate the UN Global Compact Principles and certain exclusions. It also examines whether the selected companies make a substantial effort in the climate and ecosystem challenge. More specifically, this involves promoting climate mitigation, pollution prevention and control, and the protection and restoration of biodiversity and ecosystems.

Social characteristics are promoted by only investing in companies that do not grossly violate the UN Global Compact Principles and certain exclusions. More specifically, the social attributes: human rights, labour rights, good health and good financial health are promoted.

Investment strategy

DD Equity Fund is a global equity fund that invests in a diversified portfolio of high-quality companies that operate at the forefront in terms of sustainability. The companies in the portfolio meet the quality criteria set by the Asset Manager (the so-called ‘schijf van vijf ); leaders in sustainability, a strong business model, a proven track record in terms of revenue and profit growth, a strong balance sheet position and an attractive valuation.

To ensure that investments are only made in sustainability frontrunners, the Asset Manager conducts an ESG analysis. ESG stands for Environmental, Social and Governance. ESG analysis includes a large number of indicators that map a company’s environmental and social characteristics. These may include information on CO2 emissions, biodiversity, water use and recycling, waste streams, board diversity, remuneration policy and shareholder rights.

In addition, companies may not grossly violate the UN Global Compact Principles or be on the Asset Manager exclusion list.

The Asset Manager excludes the following companies:

- Companies involved in the production of cluster munitions, anti-personnel mines, biological and chemical weapons, product of nuclear weapons.

- Companies generating more than 5% turnover from gambling.

- Companies generating more than 5% turnover from the exploitation of pornography. – Companies generating more than 5% turnover from the production of tobacco.

In addition, companies may not grossly violate the UN Global Compact Principles or be on the Asset Manager exclusion list. As a result of the ESG analysis, DD Equity Fund invests in companies that play into opportunities, offer solutions and have a positive impact with their production process, products and/or services on one of the challenges identified by the Asset Manager: climate, ecosystems and welfare. This ESG test (based on the three named challenges) uses, among others, sector-specific reports from (civil society) organizations, the company information on sustainability in annual reports and on websites and Bloomberg. In addition, discussions are held with the companies if further information and/or explanations are required.

Share of investments

The product promotes E/S features but will not make sustainable investments. DD Equity Fund is a global equity fund that invests in a diversified portfolio of high-quality companies that operate at the forefront of sustainability.

#1 Aligned to E/S characteristics includes the investments of the financial product used to meet the environmental or social characteristics promoted by the financial product.

#2 Other includes the financial product’s other investments that are not aligned with the environmental or social characteristics and also do not qualify as sustainable investments.

Monitoring environmental or social characteristics

The ESG analysis is updated every year for each company with the latest data and other details. This processmonitors whether the respective company in the investment portfolio meets the ecological and social characteristics. The company is continuously monitored for news reports. In case of a gross violation of, for example, the UN Global Compact Principles, a decision can be made to sell the position.

The exclusions list is updated at least quarterly, or if necessary e.g. due to implemented sanctions or a gross violation of the UN Global Compact Principles.

Methodologies

The ESG analysis uses the same definitions as applicable in laws and regulations. This allows DD Equity Fund to measure whether the promoted environmental and social characteristics are achieved. Investments are made only in listed companies. These companies tend to have a high degree of transparency and must comply with laws and regulations, enabling investors to better measure whether promoted environmental and social characteristics are being achieved.

Data sources and processing

Bloomberg and companies’ annual and sustainability reports and websites are used as data sources. Bloomberg data is automatically loaded into the ESG analysis of the respective company. This data is verified with public sources from the company. The data is then analysed and an impact analysis is done. No proprietary estimates are used, external data providers such as Bloomberg may use estimates.

Methodological and data limitations

The main limitation of the data sources used is that certain data is not (yet) given by companies. However, key data such as CO2 emissions, biodiversity, water use and reuse, waste streams, board diversity, remuneration policy and shareholder rights are reported by an increasing number of companies. This allows DD Equity Fund to determine whether promoted environmental and social characteristics are being achieved.

Due Diligence

The Asset Manager conducts an ESG analysis. ESG stands for Environmental, Social and Governance (ESG). The ESG analysis includes a large number of indicators that map a company’s environmental and social characteristics. These could include information on CO2 emissions, biodiversity, water use and recycling, waste streams, board diversity, remuneration policy and shareholder rights.

In addition, companies may not grossly violate the UN Global Compact Principles or be on the Fund Manager’s exclusion list.

The Asset Manager excludes the following companies:

- Companies involved in the production of cluster munitions, anti-personnel mines, biological and chemical weapons, product of nuclear weapons.

- Companies generating more than 5% – turnover from gambling.

- Companies generating more than 5% – turnover from the exploitation of pornography.

- Companies generating more than 5% – turnover from the production of tobacco.

The Manager has established compliance and risk procedures in order to monitor the implementation of the investment policy. DD Equity Fund’s annual eport is audited by an external auditor.

Engagement policy

The Administrator The Asset Manager has a Stewardship Policy (Policy on Engaged Shareholding).

For DD Equity Fund, engaged shareholdership (engagement) is an important part of the investment process. For DD Equity Fund, engaged shareholdership means:

1) knowing what you are investing in

2) investing with conviction

3) feeling responsible for investments and

4) being accountable.

In the case of entering into a dialogue with a company on environmental, social or governance issues, it is determined with whom to enter into the dialogue and the most desirable way to do so. This may vary, but often the first step is to discuss the concerns with the directors and/or supervisory directors or to write a letter outlining the concerns.

As the dialogue develops, it is determined what further steps, if any, are desirable, such as holding additional meetings with the directors and/or supervisory directors to discuss the areas of concern in particular, attending the general meeting and voicing concerns at that meeting, including voting against board proposals and intervening with other institutional investors and shareholders on specific issues. These further steps are aimed at preserving and enhancing value for clients and should promote sustainable long-term value creation at the listed companies invested in.

In carrying out its engagement activities, the Asset Manager cooperates with other shareholders where appropriate and at its discretion. This cooperation takes place in particular within Eumedion, the platform of institutional investors in the field of corporate governance and sustainability, to which the Asset Manager is affiliated.

Want to know more about sustainability and DD Equity Fund?