Disclosure of sustainability information

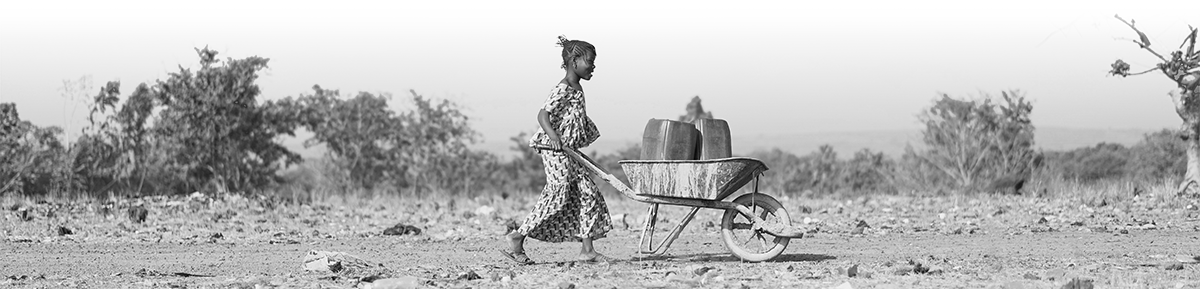

These days ‘sustainable’ has become a buzzword, so we welcome recent laws and regulations that require companies, and investors, to be more open about their actual impact on environmental and social aspects. This prevents ‘greenwashing’. The main goal is to contribute positively to major global challenges such as the climate, health and poverty.

On 10 March 2021 the EU Sustainable Finance Disclosure Regulation 2019/2088 (hereinafter also referred to as ‘SFDR’) came into force. Under the SFDR, DoubleDividend Management B.V. (hereinafter also referred to as DoubleDividend) must provide information on its website about the way in which it takes sustainability factors into account when investing. Sustainability factors are defined as environmental, social and employment issues, respect for human rights, and the fight against corruption and bribery.

DoubleDividend and its investment philosophy

Convinced that an integral analysis of financial and sustainability aspects makes a positive contribution to the risk-return profile of the investment portfolio, DoubleDividend wants to use its activities to build a bridge between financial and social returns. DoubleDividend has laid this down in its articles of association as its primary objective. Hence our name: DoubleDividend. For more information go to Investment philosophy.

We invest in companies that make a positive contribution to the climate, ecosystems or well-being through their products, services or production process. It is our belief that sustainable companies are more promising in the long term, run fewer risks and therefore deliver a better financial return.

Statement on main adverse effects of investment decisions on sustainability factors

DoubleDividend takes into account key adverse effects in its investment process. To this end, the fundmanager has conducted an ESG analysis. ESG stands for Environmental, Social and Governance (ESG). The ESG analysis includes a large number of indicators that identify a company’s environmental and social characteristics. Democracy, corruption and environmental policies are considered when selecting governments. Governments must meet a minimum score on The Economist’s Democracy Index, the Corruption Perception Index and the Yale Environmental Performance Index. DoubleDividend takes into account the main adverse effects on sustainability factors through its ESG analysis. For more information, see the statement on key adverse effects of investment decisions on sustainability factors (2023 – 2021).

Sustainability risks

Investments may be exposed to sustainability risks. In this context ‘sustainability risk’ is defined as an environmental, social or governance event or circumstance which, if it occurs, may have an actual or potential material negative impact on the value of the investment. Integrating sustainability factors into the investment policy helps manage sustainability risks.

In principle DoubleDividend invests on behalf of its asset management clients in the investment funds managed by DoubleDividend. Hence, investments are made entirely in accordance with the investment philosophy of DoubleDividend and sustainability risks are explicitly taken into account in the investment decision process. For more information about the integration of sustainability risks into the investment policy of the investment funds, ecological and/or social characteristics of the investments and adverse effects of the investments on sustainability factors, got to the Sustainability Disclosures of DD Equity Fund, DD Income Fund and DD Alternative Fund NV.